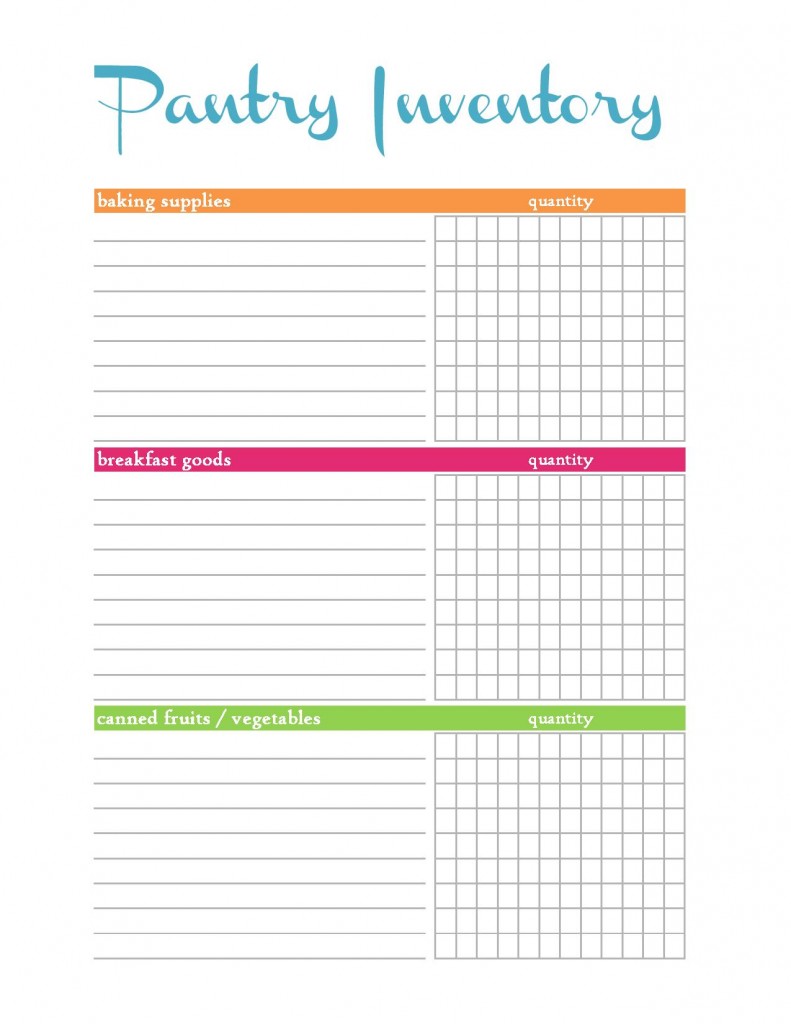

I have to tell you, taking the pantry and freezer inventory yesterday was the best use of my time in ages. Seriously, I had NO idea how much food we already have on hand. I was able to plan 2 weeks worth of breakfast, lunch and dinner meals mostly from what we already have.

Speaking of planning, I mentioned yesterday that I’ve been able to cut our grocery budget by 40% because of meal planning. This consistently makes a difference in my grocery spending. When I don’t plan – I spend more than I need to.

Honestly, meal planning can sound a lot more daunting and professional than it needs to. I take the easiest road I can. Here’s how I do it:

Get Into a Routine

My husband gets paid every other Friday and that is how we manage our budget. I take the following steps on Wednesday or Thursday so I’m prepared to shop on Friday mornings. This also coincides with having one child in school so I only need to take one along with me.

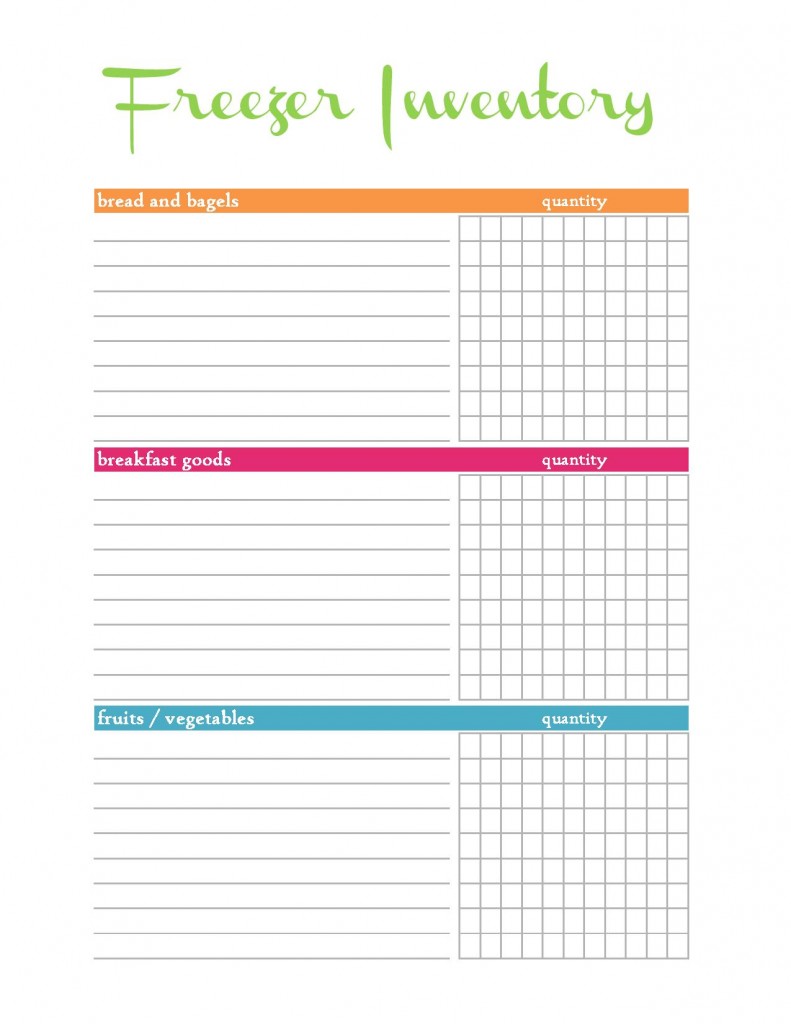

Pantry and Freezer Inventory

We covered this yesterday. Read, print the pretties, inventory.

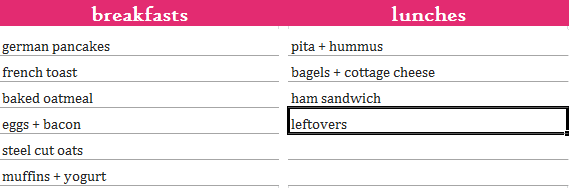

Put Together Breakfast and Lunch Meals

I know a lot of moms put together a breakfast, lunch and dinner menu but I find it easier to have a list of breakfasts and lunches that will be available after I grocery shop and then we pick what we want to make each day.

So my “meal planning” for breakfast and lunch might look like this – we also throw in fruits and veggies to each meal – whatever is on hand.

Put Together Dinner Meals

Dinner is where I really *plan*. I grab the following resources and a pen:

- my pantry and freezer inventory

- my recipe binder (a collection of my favorite recipes printed or ripped out of magazines)

- our Favorite Meals list

- my laptop open to my ‘To Make or Bake’ board on Pinterest

- my All Out Of pad

- a Meal Plan printable

1. I go through the pantry and freezer inventory and try to put together meals that only require purchasing one or two items and I write down meals on the Meal Plan, where appropriate. Notice, I don’t plan specific meals on specific days. I like the freedom to choose based on our schedule.

2. I go through our Favorite Meals list to see what I haven’t made in awhile and add those meals to the Meal Plan.

3. I go through my recipe binder and my Pinterest board to find new meals I’d like to make. I usually try to make at least one a week.

4. Once the Meal Plan is all filled out, I go through it and write down on our All Out Of pad what we need from the grocery store.

That’s it! It might sound very time consuming but I promise once you do it a few times, it will take you about 15-30 minutes. I do this about twice a month and spending no more than 1 hour per month has been worth every minute for the hundreds of dollars I’m saving each month. I often do it while watching a favorite TV show (or Presidential Debate).

I am no meal planning guru, this is just what has worked for me and saved us a lot of money along the way. If you want a step-by-step, with lots of printables, I recommend Plan It, Don’t Panic. It’s a great meal planning eBook by Stephanie Langford from Keeper of the Home.

Come back tomorrow, I’ll be writing about how I grocery shop and where to save money, particularly on natural and organic foods.

Note: I know this was *barely* actually posted on Day 4 but I promise I will be here writing all 31 days – it might just be at 11:59 pm!